How is AI better than you? More specifically, what are the areas you think AI can simply outsmart or outwork just about any human on Earth? If your response is something like “content generation,” you may simply close this window right now. Or rather, read more about AI and know the true extent of its capabilities. Once you do, you will know, it is number crunching.

You see, crunching big data and numbers was the very reason for the inception of computers in the first place (know Calculators?). Unofficially, you can compare any technological shift ever since to the amount of data the computers in that age can crunch (work on or process) in a specific time limit. Floppies – CDs – DVDs – USBs – 4G – 5G see where I’m going? In the age of AI and Machine Learning, this ability further extends to gathering useful, actionable insights from gigantic data in a matter of seconds. Now, what field of work can possibly make use of such an ability for a revolutionary shift?

One where we saw multiple screens in a room, a huge board on the wall full of graphs, lengthy company reports, and a burnt coffee on the table.

Stock traders are not the same anymore. To say AI has changed the stock trading game would be an understatement.

How and why, let us explore here.

Table of contents

Disclaimer

Before anything else, a strong disclaimer here, just like the one I repeatedly share in my article covering top AI trading tools. AI use for trading is in no way a guarantee for success, and AI should only be treated as an enabler. Base your entire trade on AI predictions, and you are bound to fail.

Also, this article in no way should be treated as professional trading advice. It simply aims to introduce readers to new AI-based trading techniques that attempt to provide an edge to traders in their efforts.

Why AI Matters in Trading: AI Benefits over Humans

As I established above, or at least attempted to, AI is fast proving to be that one big superweapon that has the power to transform stock trading forever. Over the last few years, there’s been a quiet, almost stealthy shift towards new AI-powered trading practices. And these use-cases are spread across the trading gamut, from gathering News to predicting outcomes.

The underlying advantages that AI brings, however, remain the same. Speed, efficiency, and round-the-clock operations. You see, any analyst can crank numbers out of a chart or a graph. He/ she can also spot the news and probably predict stock rise or fall accurately. But while you go through a News article over the next 5-10 minutes, AI has probably scanned the entire history of that company across the internet.

What a human can do in a day, AI can do in seconds.

And more accurately too, for AI trained on a particular practice is much less prone to making mistakes as humans do.

When you add these qualities to the fact that it can operate 24×7, without the need of any human input, its necessity in trading becomes instantly clear.

So just to reiterate, and in no modest words, AI is fast, it’s relentless, and in many cases, it can see a price move coming before you even know it’s on the way. From scanning news headlines in milliseconds to detecting subtle mood shifts in the market chatter, AI is quickly becoming the stock market’s most formidable analyst.

Then the next big question becomes – How?

AI for Stocks: The Swiss Knife of Trading

Just to be clear, there is no single “AI tool” that is here to “revolutionise” stock trading as we know it. Rather, it is an array of AI-powered platforms or services that target a very specific use case, something like what I’ve mentioned right above.

A powerful combination of hyper-targeted solutions is what makes AI 100x faster and smarter than humans in stock trading.

Let us explore all these verticals in the newly formed AI world of trading one by one:

1. Reading News faster than you can say “News”

The stock market thrives on information. The faster you get it, the faster you can act on it, and the better your chances are of making money. AI simply takes this chain of action to a whole new level.

Think of it this way, by the time you read the headline of your first news piece in the day, an AI algorithm somewhere has probably scanned the entire internet for all financial News of the day. AI models don’t just read news like us, they devour it!

What’s more, modern AI understands context. It can tell whether “factory expansion” is good news for future revenue or a risky move in a weak market. The moment an AI senses news that historically leads to a price increase, it can trigger alerts or even automate a trade. Lightning-fast trading on intel-based action.

Where do we see it?

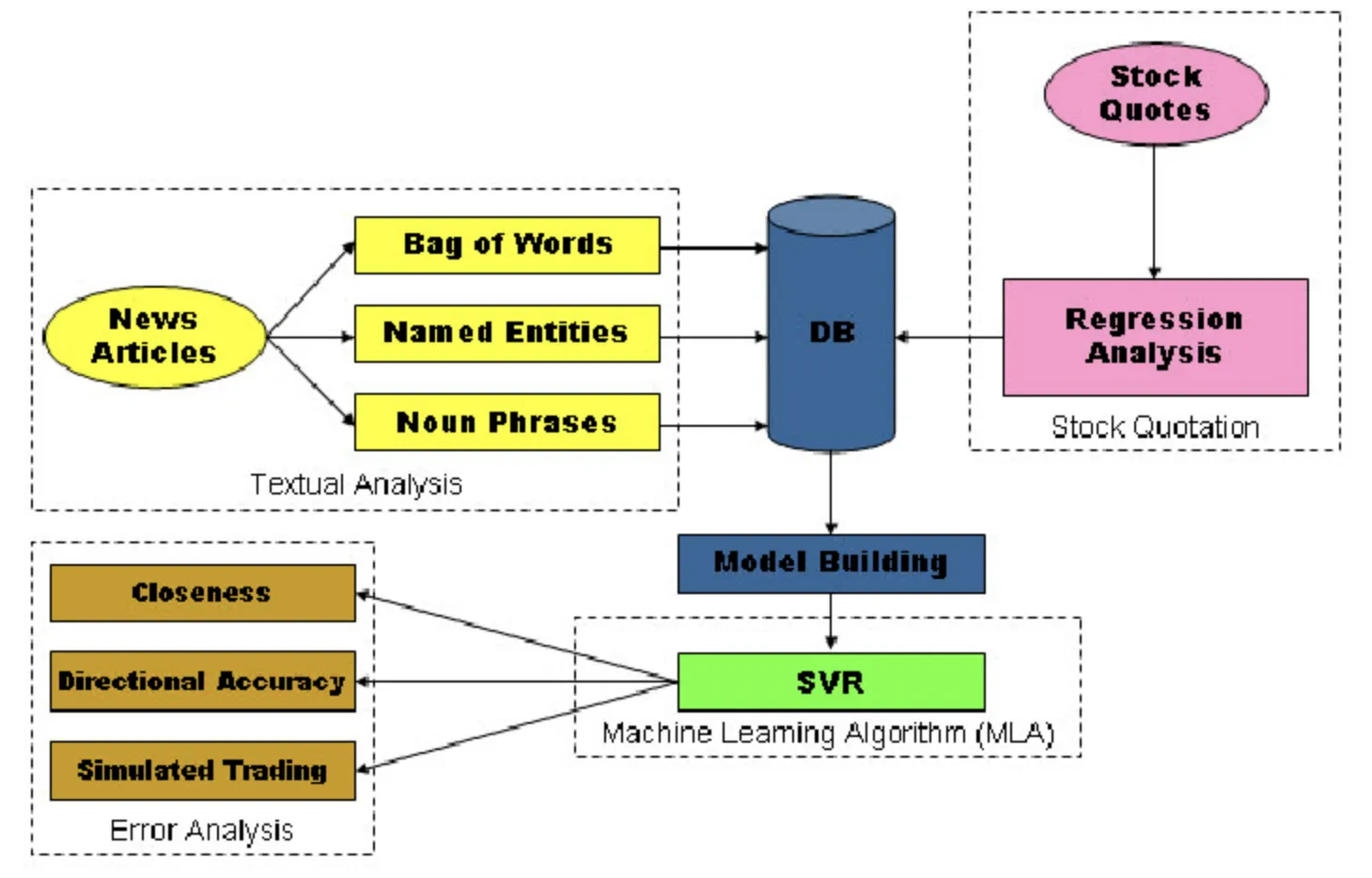

One of the earliest, well-documented academic systems known for using financial news text to quantitatively predict stock prices is AZFinText. It is prominently recognized in research, also because it demonstrated statistically significant returns by capitalizing on how market participants overreact to certain news sentiments.

Though AZFinText isn’t something you can just install and run today. Tools like Tickeron, Kavout, and Sentieo offer real-world implementations of this concept – commercialized and user-friendly.

How to use it

If you want to spot a winning stock the way AI does, you need a battle plan. Start with Tickeron to hunt for patterns the human eye would miss. Next, run those leads through Kavout to get a ranked, AI-filtered shortlist of the most promising contenders. Finally, bring in Sentieo to dig deep into the data, uncover hidden drivers, and sanity-check the hype.

Follow this sequence, and you will be highly efficient in anticipating the market. Remember, it is not about replacing your judgment with an AI; it is about supercharging it to see tomorrow’s moves today.

2. Spotting Trends from a mile away

If news is the market’s official voice, social media is its unfiltered gossip. Twitter threads, Reddit posts, and forums like StockTwits are where investor sentiment brews.

And AI is listening 24×7.

Through sentiment analysis, AI tools measure the emotional tone behind thousands of online posts per second. Is the buzz around a company cautiously optimistic, or outright euphoric? Is there a sudden spike in chatter about a little-known stock? These subtle changes in conversation often appear hours before a stock’s price starts moving. AI catches them in real time, giving traders a head start that even the most caffeinated human can’t match.

Where do we see it?

This knack of AI for spotting trends is seen in tools like TrendSpider, TradingView’s AI Screener, and Accern. These platforms crunch years of price data, volume spikes, and correlated events to flag early trend formations. This is often before these trends show up in mainstream charts. The magic lies in detecting subtle shifts in momentum and sentiment that human traders might overlook.

How to use it

Start with TrendSpider to auto-detect chart patterns and trendlines without manual guesswork. Feed those insights into TradingView’s AI Screener to refine them with real-time market filters. Finally, run the shortlisted picks through Accern to add a news and sentiment overlay. This confirms that the momentum has a solid story behind it.

By chaining these tools, you’ll spot trends faster, validate them with multiple signals, and enter positions while the rest of the market is still catching on.

3. Finding Patterns amid chaos

If a company comes out with good earnings, any trader can tell that its stocks will shoot up. However, stock trading in the market is not always as direct or easy (without AI i.e.). The more nitty-gritties you dive into, the more complex these signals become. And it somehow becomes impossible to spot a pattern, even for the most experienced eyes.

AI thrives in this chaos. It sifts through decades of historical data, current price action, trading volumes, macroeconomic indicators, and even web search trends to uncover hidden cause-and-effect relationships. In the earnings example above, an AI might find that when a company beats earnings expectations and sees a spike in Google search interest in the same week, its stock tends to rise by at least 4% in the next 10 trading days. Same prediction as a human, but much more confident, and much more specific.

In short, AI can cross-reference an extensive level of multi-layered data in real time, 24/7, to find recurring multi-factor scenarios that consistently lead to a specific outcome.

Where do we see it?

Pattern spotting in AI trading often comes paired with backtesting. Backtesting matches specific setups against decades of data to predict how they will perform in the future. Platforms like TrendSpider, QuantConnect, and Kavout scan for such repeating chart and data patterns, then simulate trades to prove whether those patterns hold up in real markets.

How to use it

Start with TrendSpider to automatically map recurring chart patterns without manual drawing. Next, move your promising finds into QuantConnect to backtest them against years of market history. This ensures you’re not chasing a one-off fluke. Finally, bring in Kavout to cross-check your shortlist against AI-ranked predictions based on fundamental, technical, and alternative data. This layered approach ensures you’re spotting not just any pattern, but the kind of high-probability setup you wanted AI’s help for.

4. Going beyond charts and numbers

Traditionally, market analysis was split into two camps. The “quants” crunched numbers, and the “fundamental analysts” analysed corporate communication like CEO interviews and earnings calls.

AI now does both.

Some investment firms, for instance, now run AI systems that monitor every major company’s public communications, alongside stock metrics. With this, they are instantly able to spot when the words don’t match the numbers, pointing to an oncoming move in stock prices.

When combined with price and volume data, such a hybrid approach often results in far more accurate predictions.

Where do we see it?

Hedge funds and research platforms like AlphaSense, Amenity Analytics, and Accern now fuse quantitative and qualitative analysis. They scan earnings calls, CEO interviews, and press releases alongside price, volume, and financial data, instantly flagging when words don’t match the numbers.

Check out how the Salesforce team uses AlphaSense for its market insights:

How to use it

Run corporate communications through AlphaSense to surface sentiment shifts and keyword patterns. Pass those to Amenity Analytics to link language to market-moving themes. Finally, use Accern to overlay these insights with price and volume data for a fuller picture, catching opportunities traditional single-track analysis might miss.

5. The AI-Human tag team

Not how AI predicts a stock rise, but definitely worth putting in this list for the best results. As they say, AI alone cannot deliver the best results and often needs human supervision. Let me explain with an example.

Imagine if an AI tool you use flags a biotech stock because of a positive clinical trial report. Based on its analysis of the initial communications from the company, often in the form of a “ground-breaking,” “earth-shattering,” “game-changing,” “teeth-brightening,” etc. etc. press release, AI may mark the stock for a sky-rocket trajectory. Only a human analyst might confirm whether the results are actually groundbreaking or just statistical noise.

The combination of AI and humans often outperforms either of those working alone.

Where do we see it

Hedge funds and investment desks use AI to scan press releases, filings, and market data, then let humans verify the findings. This cuts false alarms and blends speed with expert judgment.

How to use it

Let AI surface opportunities, then apply human expertise to validate and confirm before acting. It’s the fastest way to combine machine precision with human intuition.

Conclusion

Here’s the truth: retail investors can now access AI-powered tools that were once locked behind hedge fund doors. Platforms can send real-time alerts based on news sentiment, track unusual option activity, or even simulate how historical events would affect today’s market. But there’s a catch. While AI can point to high-probability moves, it’s not magic. Data can be incomplete, correlations can break, and markets can behave irrationally. The smartest investors treat AI as a powerful assistant, not an oracle.

Having said that, AI can make a world of difference in an environment where seconds matter. Its ability to analyse news, social sentiment, and historical patterns faster than any human means it will continue to play an outsized role in predicting market moves. The real question isn’t whether AI knows a stock will rise before you do. It is how you get that knowledge for yourself, and how you plan to use it once you do.