Artificial Intelligence (AI) is not a future concept anymore. AI has become a requirement for many industries, including healthcare, finance, education, and entertainment. The global market for AI is projected to be over $1.8 trillion by 2030 and is rapidly growing. Generative AI models, such as ChatGPT, have changed the way we communicate with technology. It enabled analytics and automation, which are changing how companies will have to operate worldwide. But these early adopters are have a lead in the AI race, and are trying their damnest to maintain it. This makes it a bit hard for the up-and-comers to find their place. This article details this race, the participants, and how they are gatekeeping the higher-echelon from AI startups.

Table of contents

- The Global AI Race: Who Leads?

- The Rise of Indian AI Startups

- Why U.S. Giants Suddenly Dropped Prices in India?

- Why This Could End Indian AI Startups?

- Why Do Tech Giants Want More Followers?

- Lessons from Builder.ai: A Warning!

- Policy Solutions: How India Can Save Its AI Ecosystem

- The Last Nail? Or a Rebirth?

- Frequently Asked Questions

The Global AI Race: Who Leads?

The leading players in AI are U.S.-based tech giants such as OpenAI, Google, Microsoft, Meta, and Anthropic. These companies dominate cutting-edge research, large language models (LLMs), and distribution platforms. Meanwhile, China has developed its own AI ecosystem, featuring Baidu, Alibaba, and Huawei, mainly for domestic use due to its restricted internet policies.

The Rise of Indian AI Startups

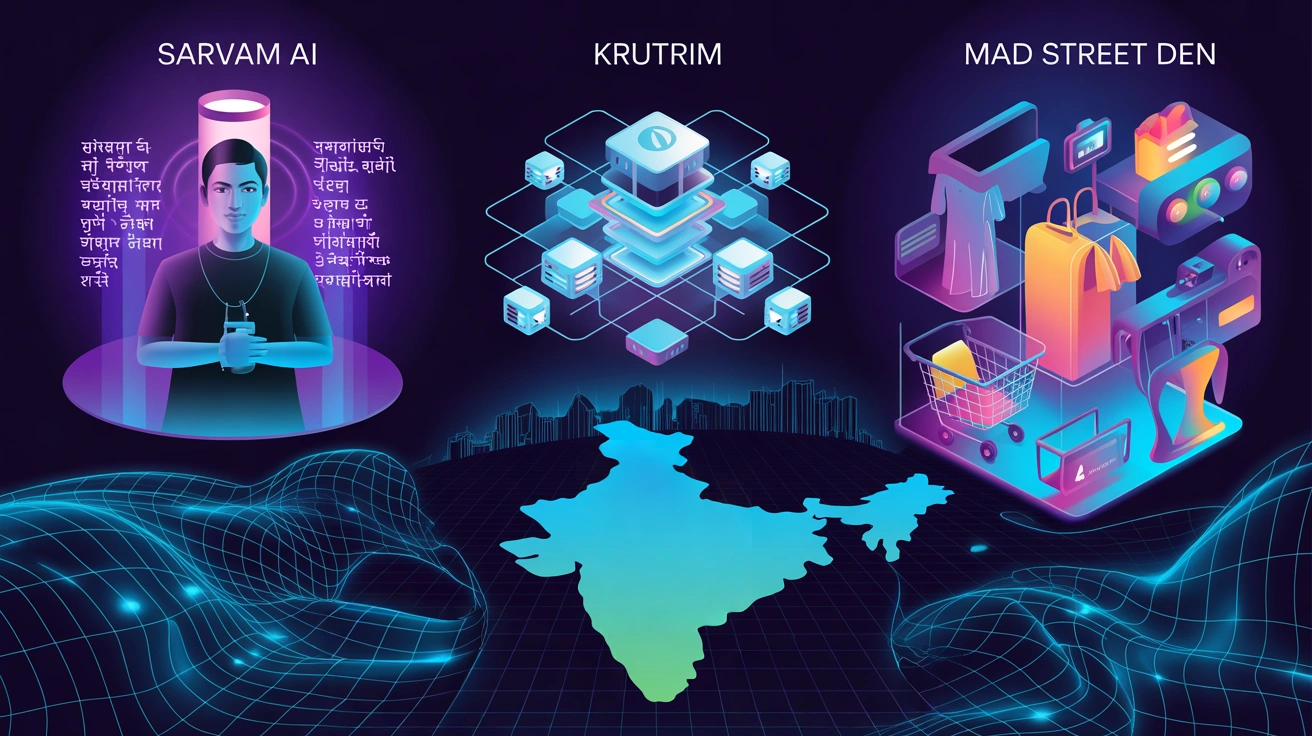

India, with the world’s largest open internet user base of over 850 million, has seen a rapid growth of AI startups in recent years. Companies like Sarvam AI, Krutrim, and Mad Street Den are working to create local solutions for Indian languages, retail, and healthcare. Investors have poured millions into this sector, hoping India can not only consume but also create AI innovations.

Why U.S. Giants Suddenly Dropped Prices in India?

Recently, OpenAI launched its most affordable subscription plan in India, ChatGPT Go, priced at just ₹399 per month. This is much cheaper than in the U.S. and Europe. Google, Meta, and others are also aggressively pricing their AI tools for the Indian market.

Why India? The closed internet in China prevents U.S. tech giants from entering, making India the largest open market. To gain mass adoption and access to data, these companies are almost subsidizing AI usage here.

Why This Could End Indian AI Startups?

While low-cost or free AI tools benefit Indian users, they pose a serious threat to Indian startups. No small company can compete with global giants offering advanced models at such low prices. This strategy reflects what Big Tech has done in the past:

- Meta (Facebook) provided free access through “Free Basics” to gain users.

- Google offered free email, storage, and services to create dependency.

- Amazon cut e-commerce margins to eliminate competition before raising prices.

Now, AI is the next battleground, and Indian startups could disappear before they have a chance to grow.

Why Do Tech Giants Want More Followers?

The goal is clear: data and control. More users mean more data to improve models, stronger network effects, and eventually domination over how people access AI globally. In the long run, once competition is gone, prices can be increased, leaving countries like India reliant on foreign AI.

Lessons from Builder.ai: A Warning!

The fall of Builder.ai, once valued at $1.5 billion, reminds us that not all AI startups survive. Reports showed it depended heavily on human engineers (over 700 engineers working in tandem) rather than true AI, damaging investor confidence. Indian startups could face a similar outcome if they cannot compete with global giants, or adopt a haphazard approach.

Policy Solutions: How India Can Save Its AI Ecosystem

If India wants to avoid becoming merely a consumer market, it needs urgent policy changes. Here are some strategies that could help Indian AI startups survive:

- Government-backed AI Fund: Similar to the Startup India Fund of Funds, a dedicated AI Innovation Fund should be established. This could provide early-stage capital to AI startups focusing on local-language models, healthcare AI, and agricultural AI.

- Data Sovereignty Framework: Big Tech thrives on having unrestricted access to Indian user data. India should strengthen data localization laws to keep important datasets, especially language, health, and biometric data, on Indian servers. This will allow Indian AI companies to work with local data.

- Public-Private Research Collaborations: India’s top institutes like IITs, IISc, and IIITs should partner with startups through government programs to develop competitive open-source Indian LLMs. Just as the U.S. DARPA funded AI innovations, India can support homegrown research.

- Preferential Procurement Policies: The government can set an example by using Indian AI solutions in healthcare, defense, and administration. This would help startups gain both revenue and credibility.

- Skill Development and AI Workforce Training: India has millions of engineering and pharma graduates, but lacks AI-ready talent. A national AI training program could ensure that Indian companies do not have to rely on foreign-trained experts.

- Fair Competition Laws Against Predatory Pricing: Regulators like CCI (Competition Commission of India) should monitor closely to prevent global companies from using predatory pricing to eliminate Indian firms, only to raise prices later when competition is gone.

The Last Nail? Or a Rebirth?

The rapid price cuts by U.S. tech giants may be welcomed by Indian consumers in the short term, but this could signal the end for Indian AI startups. Without protective measures, India risks becoming a consumer rather than a creator of AI.

However, with the right policies, investments, and collaborations, India can still emerge as a global AI hub. The country’s large internet user base, diverse linguistic datasets, and young tech workforce provide a unique opportunity. The question is: Will India take action in time, or let another technological revolution pass it by?

Frequently Asked Questions

A. AI adoption across industries, generative AI breakthroughs, and a projected $1.8 trillion market by 2030 are fueling rapid growth.

A. U.S. giants like OpenAI, Google, Microsoft, Meta, and Anthropic, with China building a parallel domestic ecosystem.

A. To capture India’s large open internet market, gain mass adoption, and collect valuable user data.