Companies require efficient systems for the processing of documents using AI. Developers find it really tricky to select the right model. It’s very important to select the most efficient model in terms of speed, accuracy and cost. We conduct a comparative study on three well-acknowledged AI models: DeepSeek OCR, Qwen-3 VL, and Mistral OCR.

This review will lead you to better data extraction performance. Advanced Optical Character Recognition systems empower fundamental automation in business. The following review is based on production readiness and true document understanding. Careful model selection is important for correct document analysis. The results confirm which one will be able to yield the best utility now.

Table of contents

The Evolution of Optical Character Recognition

Traditional OCR systems were aimed only at raw character extraction. They often failed with tables, columns, or complex document layouts. Today, modern AI-native models use vision-language architectures. These systems introduce deep context understanding and better Layout Understanding. They are aware that text lives in a structure, not just a stream. This capability takes the field beyond just simple character error rate counting. According to a recent industry report, 70% of enterprise users seek better structural fidelity in OCR. This change means the models have to master the accurate OCR while preserving form logic.

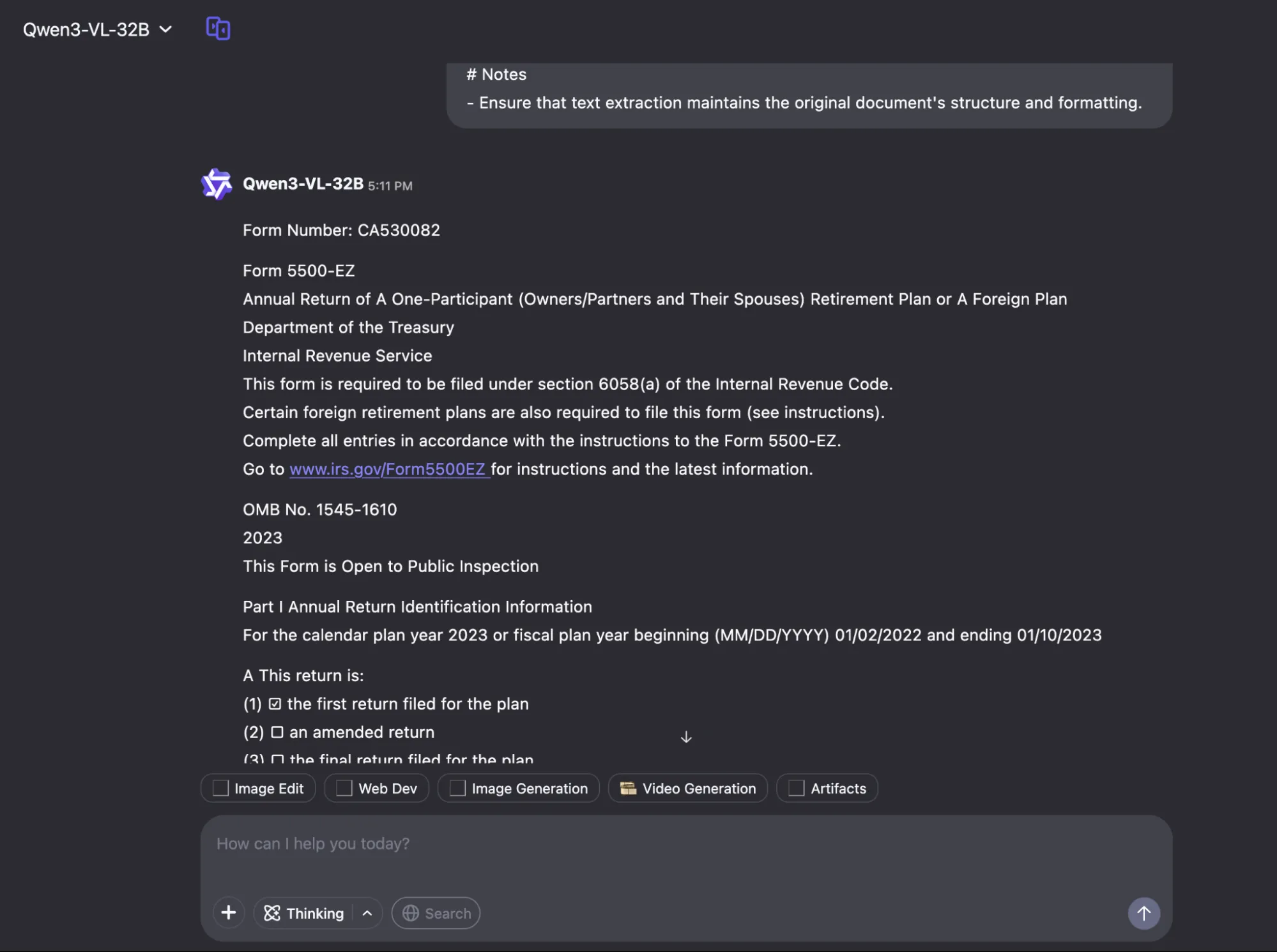

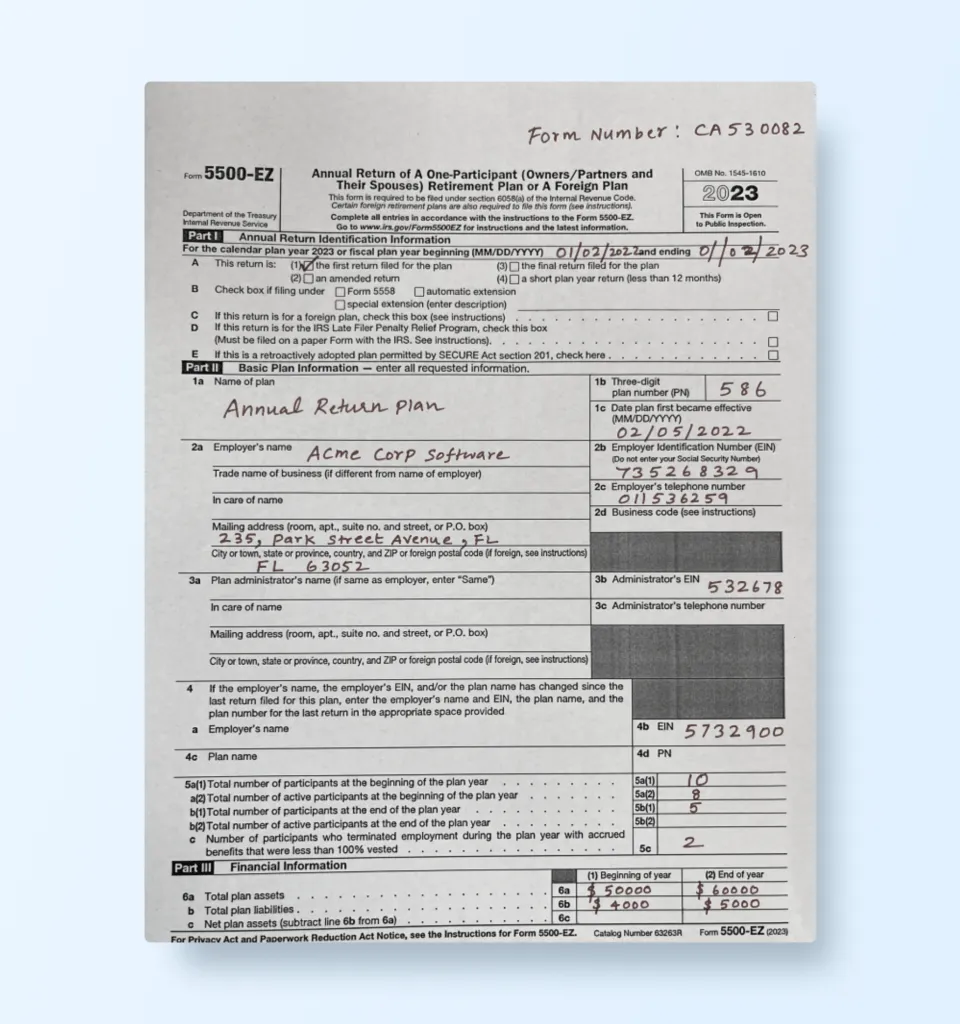

Why We Chose this Image for the test?

Selecting a test document requires certain challenges. IRS Form 5500-EZ has complex and sensitive data fields. It includes handwritten and printed elements across a dense layout, thereby making it appropriately dual in nature for raw OCR testing. The dotted lines and the various fields force the models to deliver superior Layout Understanding. Accurate field extraction is necessary for correct AI Document Processing. Errors on tax forms have clear, quantifiable business impact. This form provides a rigorous test for true competence in Document Analysis.

DeepSeek OCR vs Qwen-3 VL vs Mistral OCR Overview

DeepSeek-OCR

DeepSeek-OCR runs on a purpose-built, high-throughput architecture for enterprise scale: a two-stage encoder-decoder pipeline that compresses high-resolution documents into compact vision tokens via an encoder, DeepEncoder, with ≈380M parameters, and decodes those tokens with a sparse MoE language decoder, DeepSeek-3B-MoE with ≈570M active parameters. Its signature Optical Compression of Contexts and hierarchical global/local processing emphasize inference speed with low memory use while preserving layout and structural fidelity on large documents.

Read more: DeepSeek OCR

Qwen-3 VL

Qwen-3 VL is Alibaba’s open-weights multimodal system, built as a hybrid dense+sparse transformer (Mixture-of-Experts+dense backbones) with vision-language fusion layers and interleaved positional encodings to support extremely long context windows. Such high-capacity design-native long-context handling, multi-level ViT feature fusion, and multilingual tokenization-is targeted at complex, long-document OCR and structured extraction tasks while remaining flexible for research and engineering customization.

Mistral OCR

Mistral is a production-oriented vision-text system that has been optimized for state-of-the-art, field-level accuracy and real-world challenges. Mistral has been implemented as a four-stage transformer pipeline: image preprocessing, text detection, multi-layer transformer recognition, and post-processing/formatting. It provides consistent structured outputs: text, bboxes, and layout, and superior engineering refinements such as spell/post-process, table handling, and math, which allow for reliable downstream document automation.

Read more: Mistral OCR

Hands-On Test Execution and Analysis

We have accessed each model via its publicly available API or web platform interface. For each model, we pasted the same OCR prompt and submitted the IRS form image. This method ensures that we test the core Optical Character Recognition engine. The prompt demanded exact text extraction while preserving the original structure.

OCR Prompt: “Perform OCR (Optical Character Recognition) on the provided image or PDF document to extract all visible text exactly as it appears in the document.

# Steps

1. **Input Handling**: Ensure the input is a supported image format (e.g., JPEG, PNG) or a PDF document.

2. **Image Processing**: If necessary, pre-process the image for better OCR results. This might include adjusting brightness, contrast, or converting to grayscale.

3. **OCR Execution**: Use an OCR tool or library to scan the document and extract the text. Ensure the tool is configured to preserve the text formatting as closely as possible.

4. **Text Extraction**: Retrieve the text from the OCR output, ensuring all text is captured as it appears in the document, including punctuation, capitalization, and line breaks.

# Output Format

– Provide the extracted text in a plain text format.

# Example

– Input: An image of a printed page with text.

– Output: “This is the extracted text, maintaining punctuation and line breaks accurately as seen in the source image.”

# Notes

– Ensure that text extraction maintains the original document’s structure and formatting.”

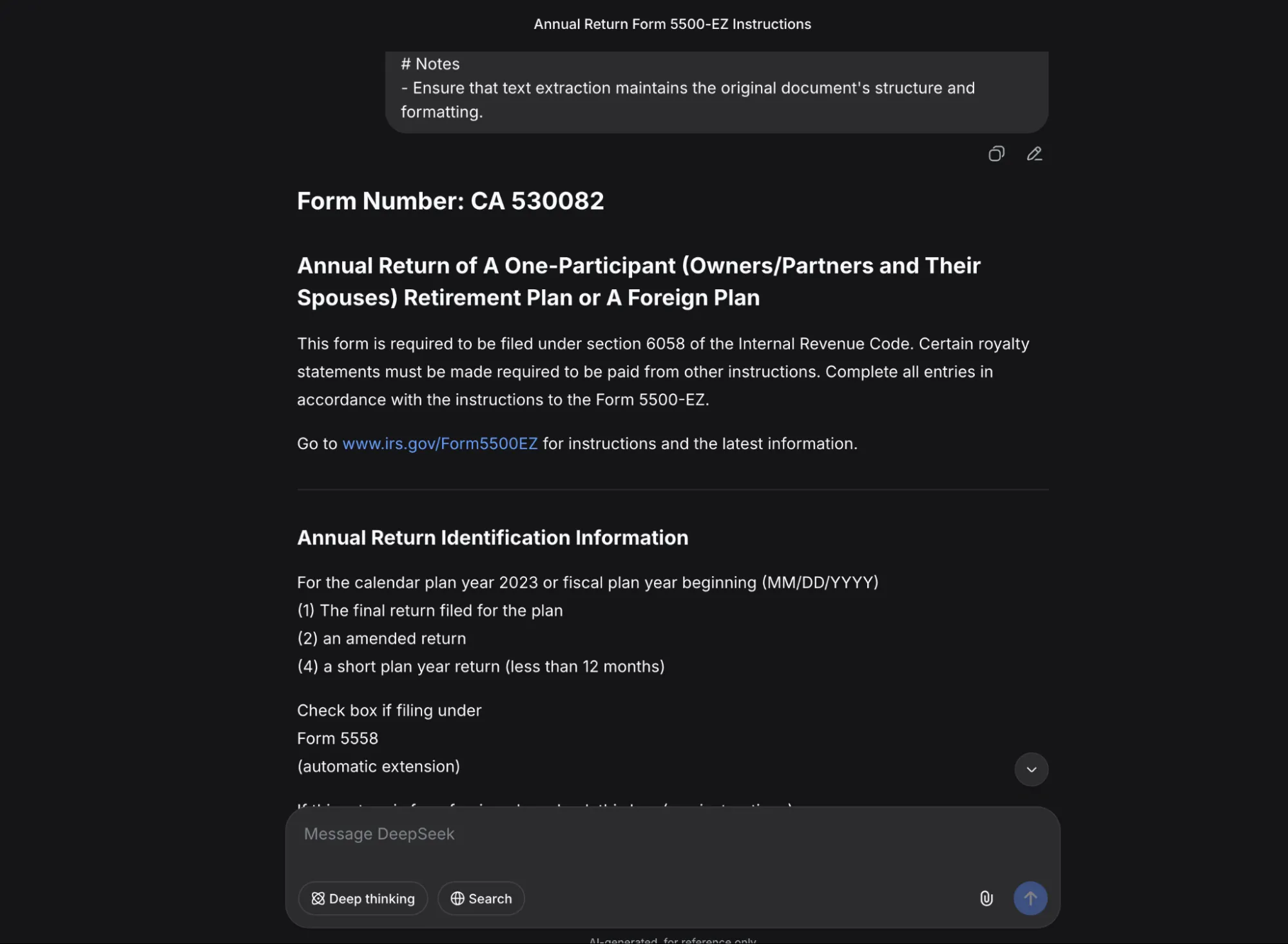

1. DeepSeek-OCR

- Head over to https://chat.deepseek.com

- Paste the OCR Prompt and the IRS form given above.

Response:

# Form Number: CA 530082

## Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan

This form is required to be filed under section 6058 of the Internal Revenue Code. Certain royalty statements must be made required to be paid from other instructions. Complete all entries in accordance with the instructions to the Form 5500-EZ.

Go to www.irs.gov/Form5500EZ for instructions and the latest information.

---

### Annual Return Identification Information

For the calendar plan year 2023 or fiscal plan year beginning (MM/DD/YYYY)

(1) The final return filed for the plan

(2) an amended return

(4) a short plan year return (less than 12 months)

Check box if filing under

Form 5558

(automatic extension)

If this return is for a foreign plan, check this box (see instructions)

If this return is for the IRS Late Filer Penalty Relief Program, check this box

(Must be filed on a paper Form with the IRS. See instructions).

If this is a retroactively adopted plan permitted by SECURE Act section 201, check here . . .

---

### Basic Plan Information — enter all requested information.

**Name of plan**

---

### Annual Return Plan

- Employer's name

- **Aone Corp Software**

Trade name of business (if different from name of employer)

In care of name

Mailing address (room, apt., suite no. and street, or P.O. box)

235, Park Street Avenue, FL

City or town, state or province, county, and ZIP or foreign postal code (if foreign, see instructions)

FL 6352

Plan administrator's name (if same as employer, enter "Same")

In care of name

Mailing address (room, apt., suite no. and street, or P.O. box)

City or town, state or province, county, and ZIP or foreign postal code (if foreign, see instructions)

If the employer's name, the employer's EIN, and/or the plan name has changed since the last return filed for this plan, enter the employer's name and EIN, the plan name, and the plan number for the last return in the appropriate space provided

Employer's name

---

### Plan name

| | (1) Beginning of year | (2) End of year |

|---|---|---|

| 6a | 5 0000 | 6000 |

| 6b | 4 000 | 5000 |

Net plan assets (subtract line 6b from 6a)

---

For Privacy Act and Paperwork Reduction Act Notice, see the instructions for Form 5500-EZ.

Catalog Number 62603Z

Form 5500-EZ (2023)

DeepSeek returned results in a solid 4-6 seconds. In contrast, its performance on Document Analysis was not very precise. The model missed several important fields in the document header. It also was off on Layout Understanding of the financial tables. Key fields had transcription errors, such as reading “ACME Corp Software” as “Aone Corp Software.” This error rate means DeepSeek’s output requires significant manual correction. Speed does not compensate for major data loss in this application.

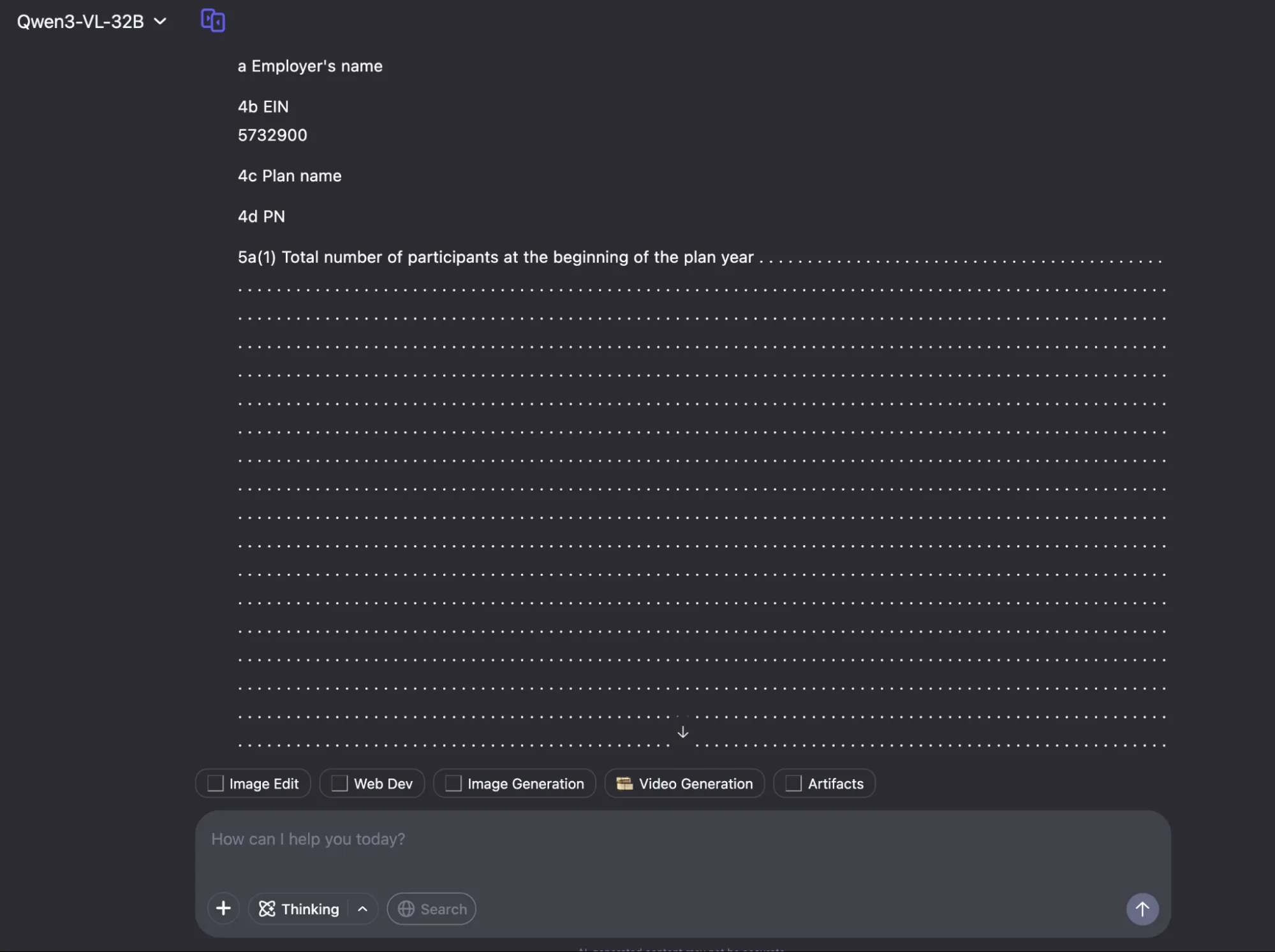

2. Qwen-3 VL

- Go to https://chat.qwen.ai/

- Paste the OCR Prompt and the IRS form given above.

Output:

Form Number: CA530082

Form 5500-EZ

Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan

Department of the Treasury

Internal Revenue Service

This form is required to be filed under section 6058(a) of the Internal Revenue Code.

Certain foreign retirement plans are also required to file this form (see instructions).

Complete all entries in accordance with the instructions to the Form 5500-EZ.

Go to www.irs.gov/Form5500EZ for instructions and the latest information.

OMB No. 1545-1610

2023

This Form is Open to Public Inspection

Part I Annual Return Identification Information

For the calendar plan year 2023 or fiscal plan year beginning (MM/DD/YYYY) 01/02/2022 and ending 01/10/2023

A This return is:

(1) ☑ the first return filed for the plan

(2) □ an amended return

(3) □ the final return filed for the plan

(4) □ a short plan year return (less than 12 months)

B Check box if filing under

□ Form 5558

□ automatic extension

□ special extension (enter description)

C If this return is for a foreign plan, check this box (see instructions) □

D If this return is for the IRS Late Filer Penalty Relief Program, check this box

(Must be filed on a paper Form with the IRS. See instructions.) □

E If this is a retroactively adopted plan permitted by SECURE Act section 201, check here □

Part II Basic Plan Information — enter all requested information.

1a Name of plan

Annual Return Plan

1b Three-digit plan number (PN)

586

1c Date plan first became effective (MM/DD/YYYY)

02/05/2022

2a Employer's name

ACME CORP Software

Trade name of business (if different from name of employer)

In care of name

Mailing address (room, apt., suite no. and street, or P.O. box)

235, PARK STREET AVENUE, FL

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

FL 63052

2b Employer Identification Number (EIN)

(Do not enter your Social Security Number)

735268329

2c Employer's telephone number

011536259

2d Business code (see instructions)

3a Plan administrator's name (if same as employer, enter "Same")

In care of name

Mailing address (room, apt., suite no. and street, or P.O. box)

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

3b Administrator's EIN

532678

3c Administrator's telephone number

4 If the employer's name, the employer's EIN, and/or the plan name has changed since the last return filed for this plan, enter the employer's name and EIN, the plan name, and the plan number for the last return in the appropriate space provided.

a Employer's name

4b EIN

5732900

4c Plan name

4d PN

5a(1) Total number of participants at the beginning of the plan year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Qwen-3 VL gave the best overall character-level OCR output. It showed excellent structural fidelity, proving strong Layout Understanding. It picked up fine details such as the checkbox mark. However, the system essentially timed out during the processing. It started giving out infinite dots while trying to finalize the extraction. This critical speed failure makes the model unusable for any high-volume AI Document Processing pipeline now. High accuracy is meaningless without low-latency delivery.

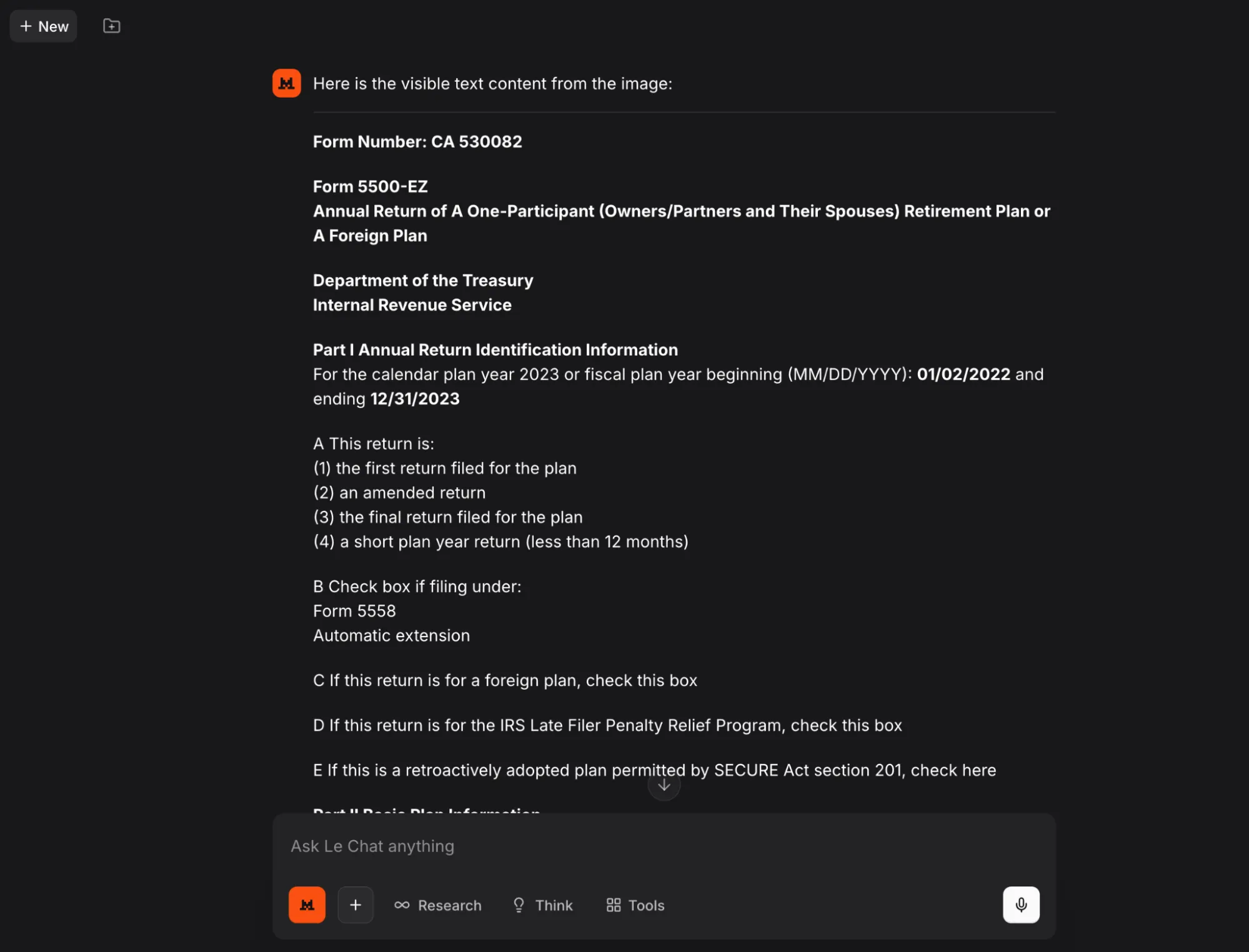

3. Mistral OCR

- Go to https://chat.mistral.ai

- Paste the OCR Prompt and the IRS form given above.

Response:

Here is the visible text content from the image:

Form Number: CA 530082

Form 5500-EZ Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan

Department of the Treasury Internal Revenue Service

Part I Annual Return Identification Information For the calendar plan year 2023 or fiscal plan year beginning (MM/DD/YYYY): 01/02/2022 and ending 12/31/2023

A This return is: (1) the first return filed for the plan (2) an amended return (3) the final return filed for the plan (4) a short plan year return (less than 12 months)

B Check box if filing under: Form 5558 Automatic extension

C If this return is for a foreign plan, check this box

D If this return is for the IRS Late Filer Penalty Relief Program, check this box

E If this is a retroactively adopted plan permitted by SECURE Act section 201, check here

Part II Basic Plan Information

1a Name of plan: Annual Return plan

1b Three-digit plan number (PN): 586

1c Date plan first became effective (MM/DD/YYYY): 02/05/2022

2a Employer’s name: ACME Corp Software

2b Employer Identification Number (EIN): 735268329

2c Employer’s telephone number: (011) 538259

3a Plan administrator’s name (if same as employer, enter “Same”): Same

3b Administrator’s EIN: 532678

3c Administrator’s telephone number:

4 If the employer’s name, the employer’s EIN, and/or the plan name has changed since the last return filed for this plan, enter the employer’s name and EIN, the plan name, and the plan number for the last return in the appropriate space provided

4b EIN: 5732900

4d PN: 586

5a(1) Total number of participants at the beginning of the plan year: 1.0

5a(2) Total number of active participants at the beginning of the plan year: 1

5b(1) Total number of participants at the end of the plan year: 1

5b(2) Total number of active participants at the end of the plan year: 1

5c Number of participants who terminated employment during the plan year with accrued benefits that were less than 100% vested: 2

Part III Financial Information

6a Total plan assets: (1) Beginning of year: $50,000 (2) End of year: $60,000

6b Total plan liabilities: (1) Beginning of year: $4,000 (2) End of year: $5,000

6c Net plan assets (subtract line 6b from 6a): (1) Beginning of year: $46,000 (2) End of year: $55,000

Catalog Number 63283R **Form 5500-EZ (20

In this exhaustive comparison, Mistral OCR had the fastest response time. It completed the entire extraction in 3-4 seconds. Its output format was neat and well-structured. It achieved very high recognition accuracy across all handwritten and printed fields. Most importantly, its Layout Understanding allowed easy consumption of the extracted data. Mistral successfully provided the most complete and usable final structure. This model also showed a unique instance of inferring the line 6c Net plan assets total, which indeed shows strong internal consistency beyond raw text.

Establishing Robust OCR Models Comparison Metrics

| Category | Metric | Mistral | DeepSeek | Qwen-3 VL |

|---|---|---|---|---|

| Speed | Latency (sec/image) | 3 to 4 sec | 4 to 6 sec | Infinite |

| Recognition Accuracy | Word or Character Accuracy | Very High | Moderate | Excellent |

| Layout Understanding | Structure F1 | Excellent | Fair | Excellent |

| Semantic Consistency | Meaning Similarity | Good with inference | Poor | Excellent |

| Output Usefulness | Field Extraction Quality | Excellent | Poor | Excellent |

Final Verdict: DeepSeek OCR vs Qwen-3 VL vs Mistral OCR

Practical application demands a trade-off between accuracy and speed. In real-world situations, theoretical high performance is not enough to ensure success. Hands-on testing makes this fact very clear.

Mistral OCR offered the best balance for this specific document analysis task: it combined high accuracy, excellent layout understanding, and the fastest processing speed. The minor issue with outputting the calculated value is a trade-off for overall usefulness.

Qwen-3 VL was strong in recognition but couldn’t pass the latency test. DeepSeek OCR was fast, but its poor Optical Character Recognition performance disqualifies it for complex forms. For robust AI document processing, select an architecture that has proven speed and structural fidelity. Industry trends are moving away from pure brute-force accuracy alone toward fast, accurate, and context-aware extraction.

Conclusion

Modern OCR choices come down to balancing accuracy with real production speed. Benchmark scores matter, but real-world reliability matters more. Mistral stands out because it delivers fast results with strong layout understanding, which makes it the safest pick for serious document-processing work. DeepSeek is quick but struggles with consistent OCR quality, and Qwen-3 VL reads well but fails on latency, which makes it risky for enterprise use. When delay can break a workflow, dependable speed and structural fidelity outweigh theoretical accuracy. Choose the tool that proves it can perform under real conditions.

Frequently Asked Questions

A. Qwen-3 VL delivered the best character-level Optical Character Recognition. However, its slow speed made the output delivery unsuccessful.

A. Field extraction just assures that the structured data is correct and prepared for automation. High accuracy means very little without Layout Understanding behind it.

A. Mistral inferred the value of Net Plan Assets from the other lines. Though correct, strict OCR requires capture of only text visible.